|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Fast Equity Loans: A Comprehensive GuideFast equity loans are a popular financial product that allows homeowners to access the equity in their homes quickly. These loans offer a convenient way to secure funds for various purposes, such as home improvements, debt consolidation, or emergency expenses. However, like any financial decision, it's essential to understand the pros and cons before proceeding. What Are Fast Equity Loans?Fast equity loans are a type of secured loan where the borrower uses the equity in their home as collateral. The process is typically quicker than traditional mortgage refinancing, providing homeowners with faster access to funds. For more insights on how these loans compare to other options, you can explore 30 year home mortgage rates to understand the broader landscape. How They WorkThese loans function by allowing you to borrow against the market value of your home, minus any outstanding mortgage balance. Lenders assess the available equity and determine the loan amount based on their criteria.

Pros and Cons of Fast Equity LoansAdvantagesFast equity loans can be beneficial under the right circumstances.

DisadvantagesDespite their benefits, fast equity loans come with certain risks.

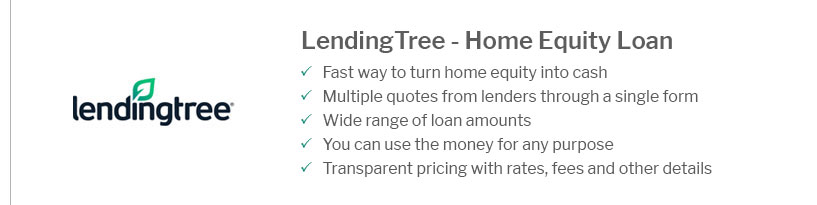

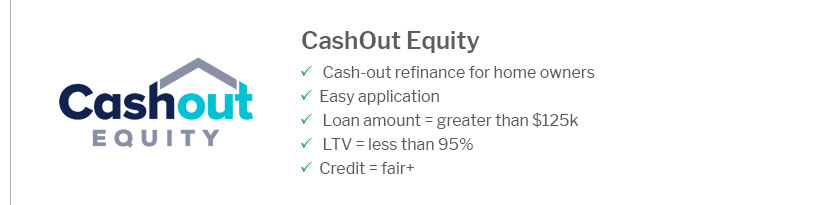

Alternatives to Fast Equity LoansConsidering alternatives can help in finding the best financial fit. Options like the best heloc loans might offer different benefits, such as more flexible repayment terms. FAQ SectionWhat is the typical approval time for a fast equity loan?Approval times can vary, but many lenders offer decisions within 3 to 5 business days. Are there any prepayment penalties?Some lenders may charge prepayment penalties, so it's crucial to review your loan agreement carefully. Can I apply for a fast equity loan with bad credit?While having bad credit can make it more challenging, some lenders specialize in offering loans to those with less-than-perfect credit. Expect higher interest rates in such cases. https://www.citizensbank.com/home-equity-loans/home-equity-line-of-credit-heloc.aspx

Citizens FastLine is our digital application experience that allows you to get a home equity line of credit faster and with less paperwork. https://www.fastcu.com/mortgage-home-equity-loans/

HELOC is a revolving credit line with an adjustable interest rate, perfect for repairs or. https://www.citizensbank.com/learning/faster-smarter-way-to-finance-projects.aspx

A faster and smarter way to finance your next project. Citizens FastLine makes getting a home equity line of credit simpleits streamlined digital experience ...

|

|---|